As one of Japan's largest energy development companies, we strive to realize a "responsible energy transition" through the stable supply of oil, natural gas and low-carbon energy and towards a shift to next-generation energy solutions.

01 Who We Are, What We Do

We are committed to contributing to the creation of a brighter future for society through our efforts to develop, produce and deliver energy in a sustainable way.

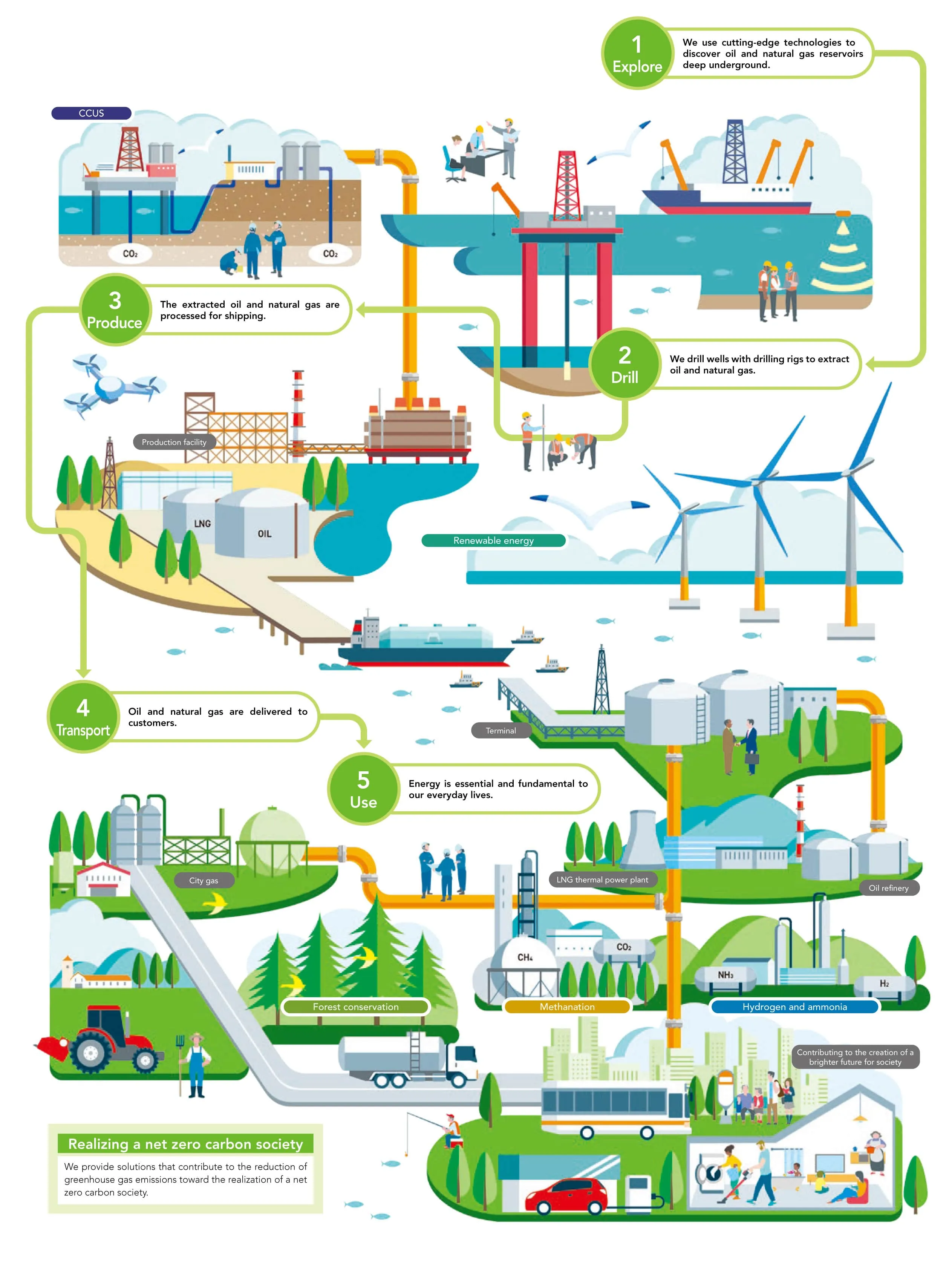

INPEX's Business

In addition to the oil and gas business, INPEX provides low-carbon solutions

centered on hydrogen and CCS.

As a comprehensive energy development company,

INPEX contributed to the development of clean and high value-added power supply

systems by combining renewable energy and storage batteries.

Key projects

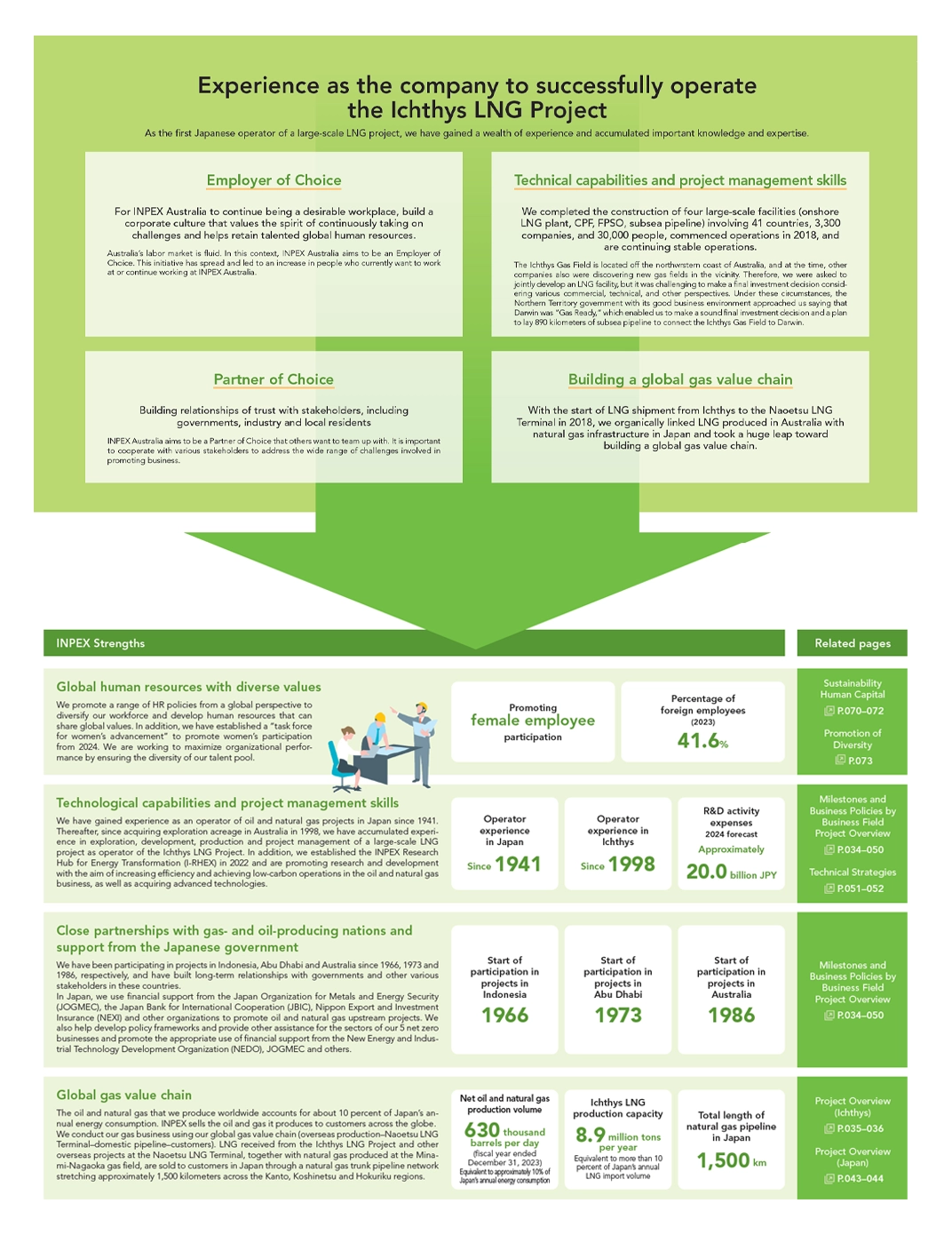

Australia

Ichthys LNG Project

Abudhabi

Abudhabi Oil Field Project

02 INPEX Key Figures

Oil & Gas Development&Clean Energy

Oil & Gas Production

of about 10% of

Japan’s energy

consumption

Net Profit

427.3Billion yen

(FY 2024)

INPEX business

90% located

in overseas

Market Capitalization

About2.4trillion yen

(as of December, 2024)

Cash Flow from Operations before exploration investment*

899.9Billion yen

(FY 2024)

03 INPEX Vision 2035

04 Shareholder returns

Based on the Shareholder returns policy outlined in the Long-term Strategy and Medium-term Business Plan (INPEX Vision@2022) announced in February 2022, the Company has made it a policy to maintain stable dividend payouts during the period covered by the medium-term business plan from fiscal year 2022 to fiscal year 2024 with a total payout ratio of around 40% or greater, and a minimum annual dividend per share of ¥30, as well as to strengthen Shareholder returns through means including the acquisition of own shares based on the Company’s business environment, financial base and management conditions, etc.

Based on the Shareholder returns policy outlined in the Mid-term Business Plan 2025 - 2027 announced on February 2025, our basic policy during the period of 2025 to 2027 is to aim for a total payout ratio of 50% or more, and to strengthen Shareholder returns in line with growth in financial performance, by implementing a stable Shareholder returns through introduction of a progressive dividend payout starting with 90 yen per share annually, and by implementing flexible share buybacks in line with the business environment and financial and management conditions.