Vision 2035 – Realizing a Responsible Energy Transition outlines our long-term strategy through 2035, reflecting changes in the business environment we operate in. It also formulates our medium-term business plan for 2025 to 2027, outlining specific initiatives and goals.

As the energy transition progresses worldwide, we aim to execute a responsible energy transition aligned with INPEX Vision 2035, focusing on ensuring stable supply of lower-carbon energy in a sustainable manner.

For more details on INPEX Vision 2035, please refer to the PDF document below.

What INPEX aims to achieve by 2035

INPEX will further strengthen its existing projects as a source of future growth

INPEX will prioritize safe and reliable operations above all else. We remain committed to ensuring stable energy supply while securing cash flow to support shareholder returns and growth investments.

Make future breakthroughs a reality

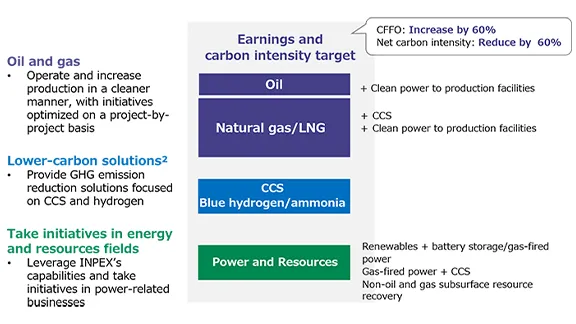

Our focus remains on expanding our supply capacity of natural gas as a pragmatic transition fuel, while pursuing businesses in the low-carbon fields and the power-related fields where complementary effects and synergies can be maximized. Through these initiatives, we aim to expand revenue base and make progress toward net zero by 2050. Additionally, we aim to expand our businesses in our core business regions, and increase shareholder returns in line with performance growth. We envision the following pillars for growth.

| Pillar for Growth 1 - Expand natural gas and LNG business |

Expand liquefaction capacity of the Ichthys LNG while maintaining safe and reliable operation Aim to achieve FID*1 for the Abadi LNG project by 2027, with a target to start up by beginning of 2030s Strengthen LNG trading capabilities to achieve a more flexible supply Focus on exploration activities in high-potential areas where early monetization is possible |

|---|---|

| Pillar for Growth 2 - Provide lower-carbon solutions leveraging CCS and hydrogen |

Promote lower-carbon solutions by leveraging INPEX’s capabilities and technical expertise Reduce GHG emissions by integrating CCS into our natural gas/LNG projects and provide GHG reduction solutions and supply blue hydrogen to third parties |

| Pillar for Growth 3 - Drive initiatives in the energy and resources fields by leveraging INPEX’s distinctive capabilities |

Aim to expand Our businesses in power-related fields as an integrated energy company Contribute to the development of a high-value-added power supply system by combining renewables with balancing power sources such as battery storage and cleaner gas-fired power generation*2 Explore opportunities to extract non-oil and gas subsurface resources that support the enhancement of energy supply system |

-

*1Final Investment Decision

-

*2Aim to reduce GHG emissions by integrating CCS with the co-firing or full combustion of blue hydrogen.

The Vision for 2035: Our 60-60 Targets for Growth and Decarbonization

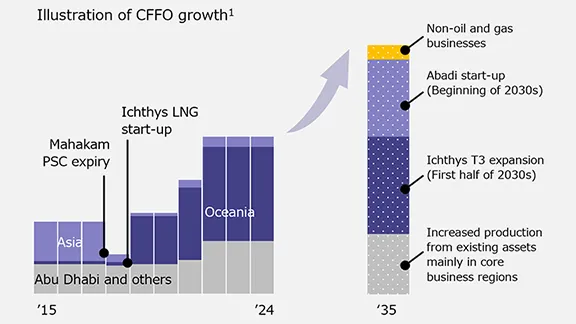

Grow business scale by 60%

INPEX grew largely over the last decade through starting up Ichthys LNG and expanding its business in Abu Dhabi. Over the next decade, we aim to continue to grow by executing development projects such as Abadi LNG and Ichthys LNG expansion, while ensuring profitability.

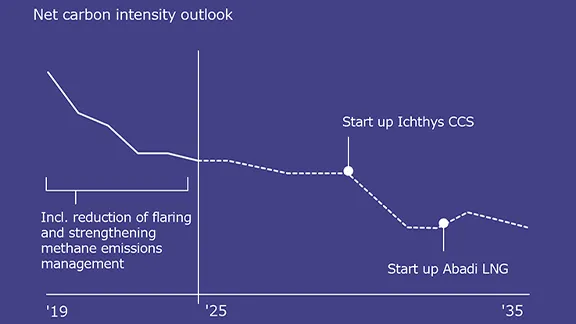

Reduce net carbon intensity by 60%*2

INPEX has a track record of reducing its net carbon intensity by optimizing production processes. INPEX will aim to achieve further large-scale reductions in the next decade through CCS while contributing to the decarbonization of society*3.

-

*1A preliminary estimate based on an assumption of a stable external business environment for both past and future (inflation rate of 2.3% applied for both costs and revenues from 2025 onwards).

-

*2Reduction target from 2019 (Scope 1 and 2) on INPEX equity share basis. Note that the reduction target reflects the current economic environment and reasonable expectations. This is premised on a business environment of consistent progress in decarbonization technology, economic rationality and realization of policies in each country and region.

-

*3For projects that were operated as of 2019, we aim to reduce emissions on an absolute basis. We will further take initiatives in collaborating with supply chain stakeholders to reduce Scope 3 emissions. Furthermore, through low-carbon initiatives leveraging CCS and hydrogen, as well as renewable energy projects, we aim to contribute to a reduction of 8.2 Mtpa in GHG emissions (the amount our company contributes to GHG emission through products and services).

Pillar for Growth 1: Expand natural gas and LNG business

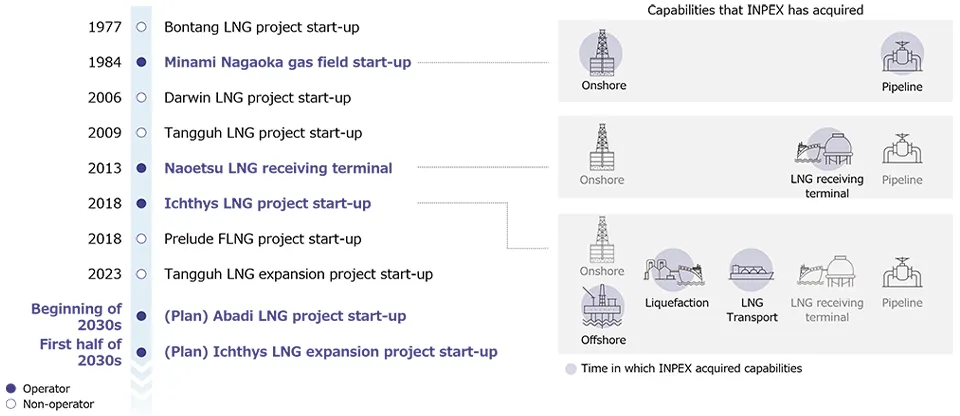

As one of few companies with a strong track record in developing and operating natural gas and LNG facilities across the entire value chain, INPEX aims to achieve significant growth over the next decade by developing Abadi LNG project and expanding Ichthys LNG.

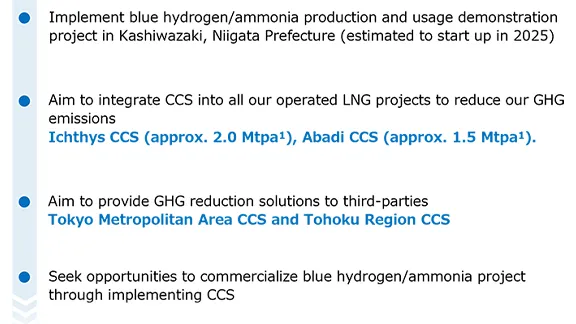

Pillar for Growth 2: Lower-carbon solutions leveraging CCS and hydrogen

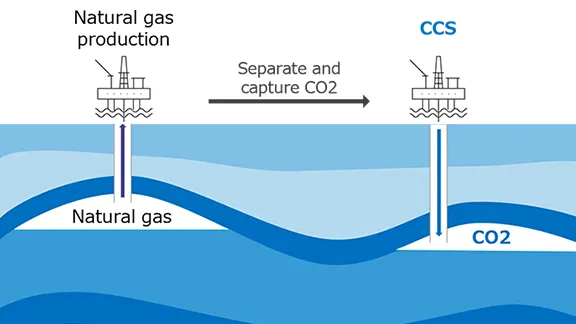

INPEX aims to achieve cleaner natural gas and LNG businesses through significant GHG emissions reduction by implementing CCS.

We aim to provide GHG reduction solutions for third parties and establish a new revenue stream.

CCS is a GHG reduction technology

that makes use of INPEX’s accumulated expertise

CCS is a process where CO2 is captured from Oil and gas production or industrial emissions, then transported and stored deep underground.

CCS has a potential of significant GHG emissions reduction

In addition to reducing our own GHG emissions, we also aim to provide GHG reduction solutions to third parties

Direction of our initiatives toward 2035

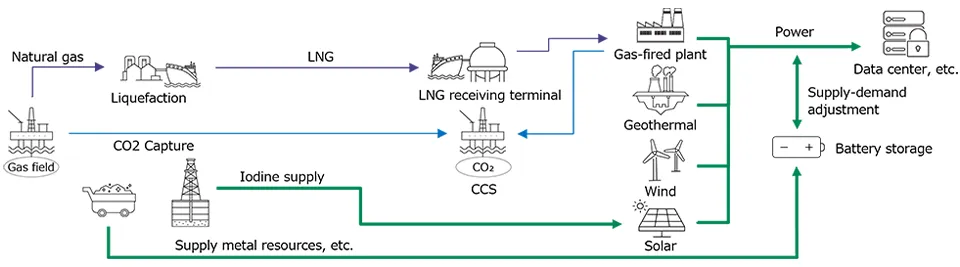

Pillar for Growth 3: Drive initiatives in the energy and resources fields

INPEX aims to establish new revenue streams by pursuing opportunities in power-related business fields.

Development of non-Oil and gas resources

-

Support the adoption of next-generation perovskite-type solar cells through iodine supply

-

Aim to pursue business opportunities in recovery of metal resource from brine* and other minerals and scarce resources where INPEX can leverage its distinctive capabilities

Diversify power portfolio and strengthen supply-demand adjustment capabilities

-

Enhance profitability and expand renewable energy by focusing on core business regions and fields where we can leverage our technical capabilities

-

Pursue business opportunities in cleaner gas-fired power generation, integrated with fuel supply through our existing gas pipeline networks, while exploring future possibilities for hydrogen co-firing/dedicated combustion and CCS implementation

-

Maximize the value of power asset portfolio by optimizing the combination of renewables and balancing power sources (battery and gas-fired power)

Contribute to power-intensive industries

-

Provide opportunities to enhance the efficiency and sustainability of energy supply for power-intensive industries such as data centers

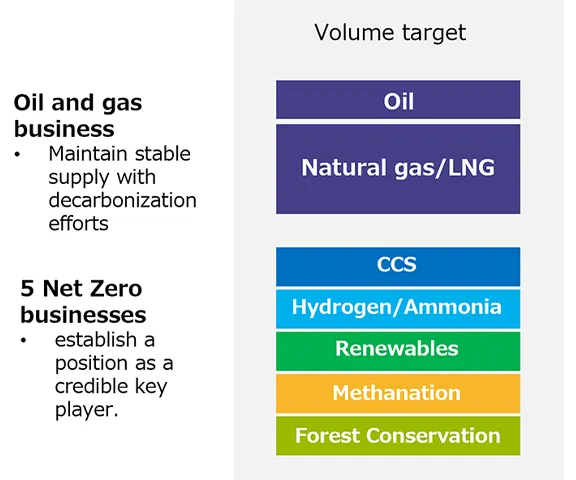

(Reference) Changes from the previous INPEX Vision

Previous Vision and Mid-term Business Plan

-

1.Net-zero challenge by 2050

-

2.Five core business regions*1

-

3.Establish 5 Net Zero Businesses, aiming to integrate both the oil and gas businesses and decarbonization initiatives

INPEX Vision 2035

-

1.Net-zero challenge by 2050 (no change)

-

2.In addition to the five core business regions, pursue business opportunities in lower-carbon solutions and power-related fields in North America

-

3.Based on three years of experience, focus on areas that are expected to contribute significantly to growth in business scale and decarbonization by 2035, and evolve our execution approach to leverage synergies across the initiatives

-

*1Core business regions are Australia, Abu Dhabi, Southeast Asia, Japan and Europe.

-

*2Including initiatives in methanation

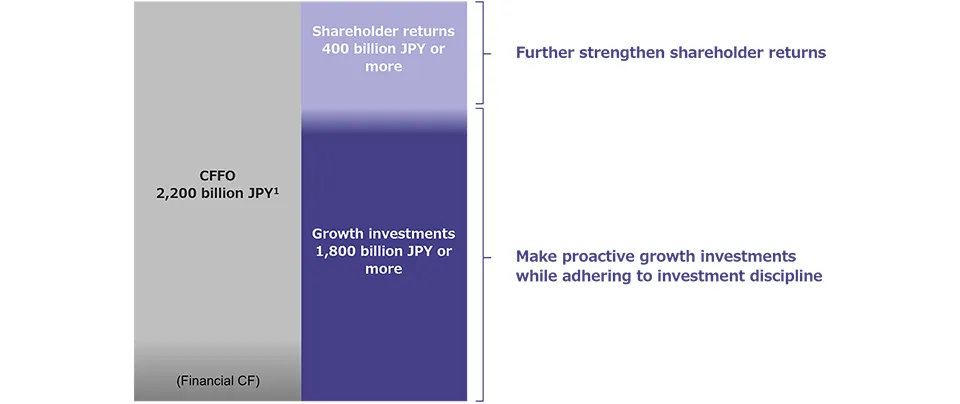

Balanced cash allocation in growth investments and shareholder returns

As the reduction of interest-bearing debt has progressed over the past 3 years, INPEX will aim to further strengthen growth investments and shareholder returns from 2025 to 2027. Growth investments will be pursued selectively in projects that leads to enhancing our shareholder value.

Further strengthen Shareholder returns

-

Maintain stable shareholder returns through dividends while executing flexible share buybacks in response to prevailing conditions

Make proactive growth investments while adhering to investment discipline

-

Pursue impactful growth, focusing on natural gas and LNG

-

Around 20% investment cash flow is expected to be allocated to lower-carbon solutions and power-related fields, with profitability thoroughly evaluated at an investment stage

-

In addition, pursue growth opportunities such as asset acquisitions and M&A to accelerate growth. Such investment will be made after carefully evaluating potential synergies, including those with our existing facilities and capabilities

Investment pipelines

-

Maintaining and expanding existing projects : Approx. 1,100 billion JPY

-

Natural gas and LNG project expansion in a cleaner manner*2: Approx. 500billion JPY

-

CCS/hydrogen and power-related fields: Approx. 200 billion JPY

(In addition, there are other potential investments: pipelines of 1,000+ billion JPY)

-

*1Assumption of $70/bbl, 135 JPY/USD

-

*2Including investments for CCS integrated into LNG projects

Key performance targets

INPEX will continue to ensure safe and reliable operation of its projects and maintain a solid profit base.

We will strive to take FID on projects including Abadi LNG, to establish a foundation for significant growth in the 2030s.

We will aim to enhance shareholder returns sustainably and will disclose the progress of Our businesses in a timely and proactive manner.

| KPI | |

|---|---|

| Major Incidents*1 | Zero |

| Shareholder returns | A progressive annual dividend payout starting with 90 JPY during the Mid-term Business Plan period (2025-2027) Aiming for a total return ratio*2 of 50% or more |

| Three years cumulative CFFO | 2,200 billion JPY or more *

Assumptions: Oil price of $70/bbl.and an exchange rate of 135JPY/USD.

|

| Net carbon intensity*3 |

35% reduction versus 2019 levels by 2027 |

| ROE | Aiming for an ROE greater than the Cost of Equity |

| ROIC | Aiming for an ROIC greater than the WACC |

-

*1Fatalities, serious injuries and major leaks(PSE Tier-1) occurring in operator projects

-

*2(Dividend payment amount + planned share buyback amount)/net income

-

*3Scope 1 and 2